Product data is critical to staying competitive, but companies are struggling with how they derive value from data, particularly test data, according to a survey of senior product executives. Poll, commissioned by NI, also found a relationship between advanced data processing strategies and increased innovation.

FT Longitude's Built to Do report surveyed 300 senior product executives, including chief product officers, senior vice presidents and vice presidents of engineering, R&D, manufacturing, operations, manufacturing and products in 10 industries, including semiconductor, transport. , consumer electronics, aerospace and defense industries. They were asked about how they use product data to help solve problems related to product complexity, cost, compliance and time to market.

The two biggest drivers of product strategy change are shorter time-to-market. - the requirements of the market in combination with the increase in the complexity of the product, noted N.I. According to the company, these issues have led to over-budget and late product releases, as well as recalls.

Key findings show that two-thirds of respondents believe data strategy is important to optimizing the product lifecycle, and 52% companies with a company-wide product data strategy achieved faster time-to-market in the past 12 months compared to 33% without a data strategy.

Despite the value of data in product development, 55% respondents cited cost as a key factor preventing them from improving their current product lifecycle.

Test data as a difference

The survey results also show that testing is an underutilized resource: 38% respondents said they rarely use testing to inform product design, and 51% believe they could extract more value from their data if they applied testing earlier in their processes.

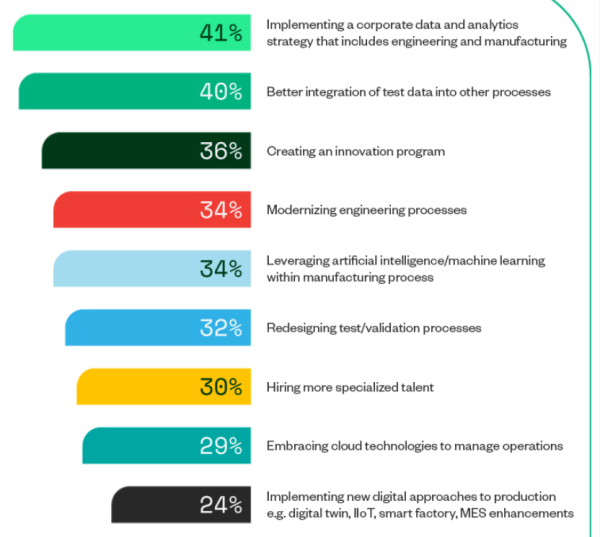

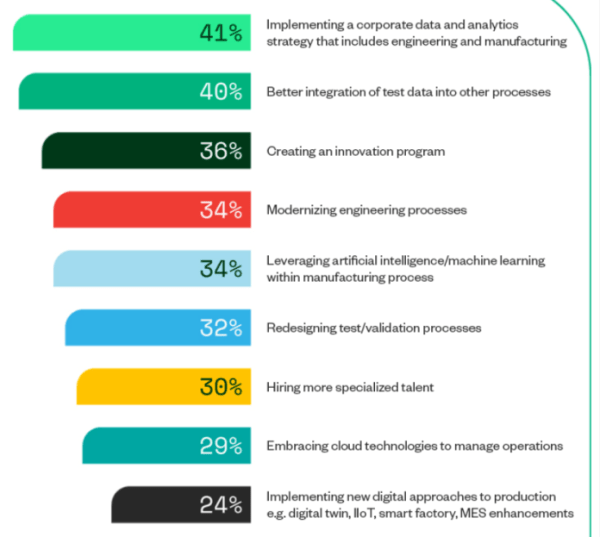

<p>Most respondents believe that the analysis of their test data is very useful. Forty percent of respondents believe that integrating test data into the product development process is one of the top initiatives that can bring the greatest business benefit, and 55% reported that integrating test data into the product development process will be a key priority over the next 12 months. .

Other top initiatives include implementing a corporate data and analytics strategy that includes design and manufacturing (41%), creating an innovation program (36%), modernizing engineering processes (34%), and using artificial intelligence/machine learning in the manufacturing process.

(Source: NI)

The main problems

The survey also found that respondents' top concerns varied by company size. For example, the top concerns cited by product innovators at companies with 1 to 500 employees include shrinking market entry requirements, labor shortages, environmental legislation, and trade barriers. By comparison, companies with more than 1,000 employees are most concerned about the complexity of customer devices, supply chain volatility, global competition and customer demands for product personalization.

A total of 57% respondents said their manufacturing processes are outdated and unable to keep up with new business and technology trends, and 46% believe their companies will lose market share within two years unless they make significant changes to their product life cycle processes.

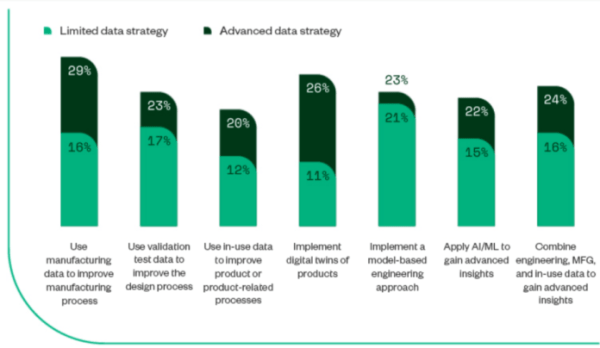

Although 65% believe that a data strategy is necessary to optimize the product life cycle, 47% companies use a limited data strategy, only 29% companies with advanced data applications are fully capable of using production data to improve production processes, and only 24 % combine engineering, manufacturing, and live data to provide enhanced insights. Additionally, 74% companies do not use product data to implement digital twins.

(Source: NI)

NI says the research indicates that companies with more advanced product data strategies have better business results. These include a higher level of innovation, productivity, production efficiency and speed to market.

But there is still a lot of work ahead.

In particular, the survey identifies test data as the most underutilized resource, with many companies dealing with inadequate data analysis and testing bottlenecks. One-third of respondents said their inability to gain insights from test data prevents them from improving the product lifecycle, and 52% said the way they collect, store, and manage test data prevents them from getting value from statistics.

<p>Overall, the results show that companies with limited data strategies are falling behind. For example, in the last 12 months, 70% of companies with limited data strategies invested in product data and analytics as a priority, compared to companies with advanced data strategies that shifted to priorities related to machine learning, digital twins and robotic process automation . .

The report also includes six tips on how to build a good data strategy. These include identifying areas for improvement, finding data sources, implementing a standardization strategy, building a product-oriented data pipeline, analyzing and acting, and scaling within the organization.

Source: electronicproducts.com