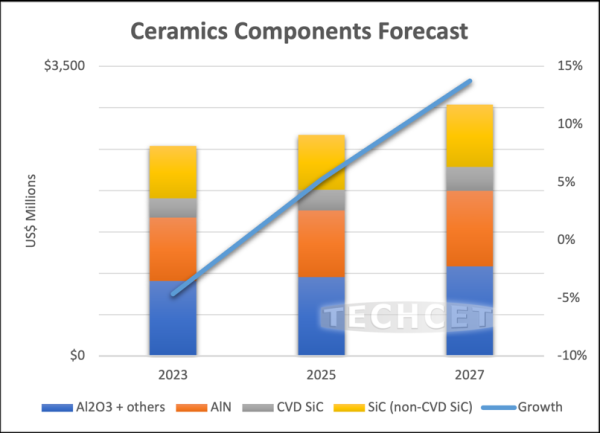

TECHCET< /b>— an electronic materials consulting firm that provides market and supply chain intelligence — announced that the market for consumable ceramic equipment parts will shrink by -5% in 2023 to $2.5 billion. Parts made of ceramics, in particular oxide aluminum (Al2O3), aluminum nitride (AlN), silicon carbide (SiC) and chemical vapor deposition SiC (CVD-SiC) are used as components of semiconductor process equipment, which means that market trends are directly related to wafer production and sales of semiconductor equipment. The ceramic parts market will grow by around 2-5% in 2024 and will exceed USD 3 billion by 2027, as shown in a graphic just released by TECHCET on the Ceramics Critical Materials Market.

Previous lags from 2020-2022 in the ceramic parts market have been gradually eliminated due to the industry slowdown, giving some manufacturers time to work on efficiency improvement projects. Long lead time for large SiC components, which used to be more than 1 year, although slightly reduced.

Semiconductor equipment manufacturers using CVD SiC will continue to use CVD SiC for the foreseeable future, fueling the growth of CVD SiC used for advanced semiconductor core equipment. New investment in CVD SiC capacity is finally starting to emerge after a previous supply shortage. The 2023 CVD SiC deadline has improved, so this is a good sign for this segment of the industry, where TECHCET expects significant growth. Considering the required costs and experience, it is difficult for new players to enter the CVD SiC Market. However, major silicon and quartz suppliers are expected to enter this market segment over the next few years.

The SiC and AlN markets will continue to show higher growth rates than alumina and other ceramic materials due to their contribution to improved productivity, reduced defects and process requirements for next-generation thermal processes.

Demand in the 200mm component market is still ongoing and well supported by small shops/ceramic manufacturers. With this in mind, there are indications that ceramic manufacturers in China will suffer more than their overseas competitors in 2023. This is due to the economic situation in China, the US/China geopolitical situation and US consumers buying fewer components from Chinese sources. In some cases, the revenues of some of these suppliers could drop significantly in 2023.

Source: electronicproducts.com