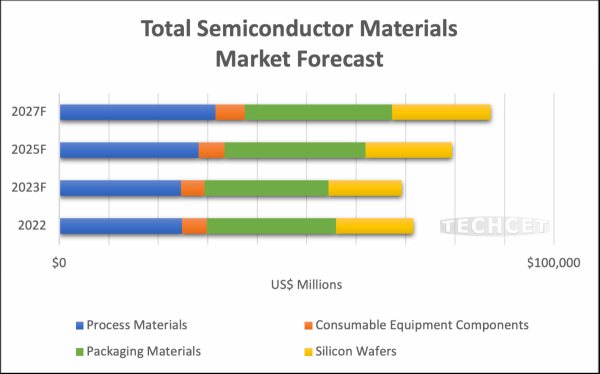

TECHCET, an electronic materials consulting firm that provides market and supply chain insights, announced that the general semiconductor materials market is forecast to recover, growing by nearly 7% in 2024 to reach US$74 billion. This turn upside followed a contraction of -3.3% in 2023 due to a general slowdown in semiconductor production and fewer wafer starts. Looking ahead, the overall semiconductor materials market is expected to grow at a CAGR of over 5% from 2023 to 2027. By 2027, TECHCET expects the market to reach $87 billion or more, with new global manufacturing frameworks contributing to a potentially larger market size. .

While the slowdown in 2023 reduced supply constraints, supply constraints are expected to resume in 2024 for 300mm wafers, epitaxial wafers, some specialty gases and possibly copper alloy targets as new plants ramp up globally. The extent of the reduction in supply will depend on delays in the expansion of material suppliers.

Significant growth in demand could strain supply chains if materials/chemicals production capacity cannot keep up with production expansion. TECHCET has been tracking the availability of high-purity chemical products in the US and has identified several areas where imports will be needed to support demand.

In addition to global manufacturing expansion, new device technologies will drive materials market growth as new materials and additional process steps are required for Gate-All-Around Field Effect Transistors (GAA-FETs), 3D DRAM and 3D NAND as layer counts approach. 5xxL. These materials include special silicon EPI/silicon germanium gases, EUV photoresist and developers, CVD and ALD precursors, CMP consumables and cleaning chemicals (including highly selective nitride etching) and more.

Other lingering supply chain constraints and potential bottlenecks could also cause problems as factories ramp up capacity. For example, geopolitical issues between China and the US are beginning to strain germanium and gallium supply chains, and rare earth supply risks are increasing due to China's large share of these materials.

Another concern in the U.S. concerns regulatory issues that could potentially limit the expansion of material supplies. Obtaining regulatory approvals can add time and cost to expansion projects. In addition, state regulations regarding EHS hazards may govern the phase-out of PFAS materials, forcing material suppliers to develop alternative replacements that take time to develop and qualify.

For more information on the segmented forecast for the semiconductor materials market, see including ALD/CVD Precursors, Wet Chemicals & Specialty Cleaners, CMP, Electron Gases, Silicon Wafers etc. visit: www.techcet.com

Source: electronicproducts.com